Introduction

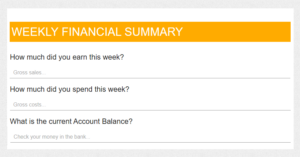

The ‘Financial Overview’ template is a simple and informal tool designed to give you a quick snapshot of your business’s financial health. It’s not intended for detailed accounting or as a basis for financial reporting to a CFO. Instead, it serves as an easy-to-use guide for general orientation. With minimal effort, you or your designated employee can update it weekly by pulling key figures straight from your business bank account. This approach makes it ideal for anyone looking to stay on top of their financial situation without diving into complex calculations or formal processes.

Form

When Is It Better to Collect Weekly Financial Data Instead of Monthly?

Collecting weekly financial data is more beneficial in scenarios where frequent insights are needed to monitor performance or make quick adjustments. For instance, businesses with high cash flow volatility, such as retail, hospitality, or seasonal industries, benefit from weekly data to identify trends, control expenses, and manage liquidity. Weekly financial tracking is also useful for evaluating the immediate effects of promotions, pricing changes, or unexpected expenses. It provides the granularity needed to make timely adjustments and ensures that potential issues, such as cash shortfalls or rising costs, are detected and addressed before they impact the overall monthly results.

Gross Profit

The financial metric that represents the total revenue of a business minus the total cost. It measures how much money remains after covering direct production or procurement costs but before deducting operating expenses, taxes, or other costs.

$$

\text{Gross Profit} = \text{Total Revenue} – \text{Total Costs}

$$

Gross Profit Margin (%)

A profitability ratio expressed as a percentage that indicates how much of each dollar of revenue is retained as gross profit. It is calculated by dividing Gross Profit by Total Revenue and multiplying by 100. This metric helps assess the efficiency of a company’s production and pricing strategies.

$$

\text{Gross Profit Margin (%)} = \left( \frac{\text{Gross Profit}}{\text{Total Revenue}} \right) \times 100

$$

Why is an increase in Gross Profit Margin beneficial?

It is undoubtedly better when the Gross Profit Margin rises, as it means your company generates a higher gross profit relative to its revenue. A higher gross margin indicates more efficient cost management or improved sales performance, which positively impacts the financial health of the business. A higher margin provides a buffer against price wars and allows the company to reinvest in innovation or marketing, strengthening its market position.

Reasons why an increase in Gross Profit Margin is beneficial:

- Higher profit per unit of sale: A higher margin means the company retains a larger portion of its revenue after covering the costs of production or service delivery.

- Improved financial flexibility: Increased gross profit provides more opportunities for investment in growth, marketing, research and development (R&D), or enhancing customer service.

- Enhanced competitiveness: A high gross margin can indicate:

- A strong market position.

- The ability to maintain higher prices (pricing power).

- Effective cost management.

Runway

Runway refers to the amount of time a company can continue to operate before depleting its cash reserves, assuming no additional funding or revenue is generated. This metric is crucial for assessing a company’s financial health and planning for future growth or necessary cost adjustments. The formula to calculate Runway is:

$$

\text{Runway (weeks)} = \frac{\text{Current Cash Balance}}{\text{Weekly Costs}}

$$

Where:

- Current Cash Balance represents the total cash available to the company.

- Weekly Costs is the average amount of cash the company spends each week to cover expenses.

Monitoring the Runway metric in weeks can be particularly useful in situations where a company operates in a highly dynamic environment, requires more precise tracking of its financial situation, or is engaged in short-term liquidity management. However, if you need it, you can always look at it on a monthly basis:

$$

\text{Runway (months)} = \frac{\text{Current Cash Balance}}{\sum_{i=1}^{4} \text{Weekly Costs}_i}

$$

Safe vs. Risky Runway Values

A safe Runway value depends on the stage and nature of your business. For early-stage startups, a minimum of 12–18 months (48–72 weeks) of Runway is generally considered safe, as it provides enough time to secure additional funding or achieve profitability. For established businesses with predictable revenue streams, a shorter Runway (e.g., 6–9 months / 24–36 weeks) might be manageable.

If your Runway drops below 6 months (24 weeks), it signals an urgent need to either cut costs, increase revenue, or secure funding. On the other hand, maintaining too long a Runway (e.g., more than 24 months / 96 weeks) without clear growth plans may indicate inefficiency in resource allocation. Ultimately, the ideal Runway depends on factors like market conditions, business model, and access to external funding.

Goals

The ‘Financial Overview’ template is designed to help you track progress and stay motivated by comparing your current results with those of the previous week. In the revenue section, green arrows indicate positive trends, while red arrows highlight declines, serving as a signal to take more focused and effective actions. Additionally, the template allows you to set your own goals, such as an annual revenue target. By breaking this target down into weekly increments, you can monitor your performance and assess whether you’re on track to achieve your plan. This flexibility ensures that the template adapts to your unique business objectives and encourages proactive decision-making.

Customization Options

Tailor the ‘Financial Overview’ template to suit your business’s unique needs with these flexible customization options:

- Adjust Key Metrics: Select the most relevant financial indicators for your business, such as Gross Profit, Runway, or Cash Flow, and remove those that don’t apply.

- Modify Data Collection Frequency: Switch between weekly, monthly, or quarterly updates based on your reporting requirements and business dynamics.

- Set Personalized Goals: Define your annual, monthly, or weekly revenue targets and customize the template to track progress towards them.

- Choose Visualization Styles: Adapt charts, graphs, and trend indicators to better match your data presentation preferences.

- Add Custom Fields: Include additional sections for specific financial insights, such as expenses by category or revenue by product line.

These options ensure that the template evolves alongside your business, providing a more precise and actionable financial overview.

Insights and Decisions

Leverage the data provided by the ‘Financial Overview’ template to gain insights and make informed business decisions,

What questions does the data answer?

- What is the current financial health of the business?

- Are revenues increasing, stable, or declining?

- How efficiently are costs being managed?

- How long can the company operate with its current cash reserves (Runway)?

- Which areas require immediate attention to improve profitability?

- Are the set goals being achieved, and how close are we to hitting the targets?

What decisions can be made based on these insights?

- Adjust pricing strategies or operational costs to improve Gross Profit Margin.

- Plan for additional funding or cost-cutting measures if Runway values drop below a safe threshold.

- Invest in marketing or growth initiatives during periods of strong financial performance.

- Reassess budget allocations to address underperforming areas or seize growth opportunities.

- Take corrective actions to align performance with set goals and improve accountability in achieving targets.

By answering these critical questions and monitoring goal achievement, the template empowers you to make strategic decisions that enhance your business’s sustainability and growth potential while staying focused on your objectives.

Conclusion

In conclusion, adopting weekly financial tracking and monitoring key metrics like Gross Profit, Gross Profit Margin, and Runway ensures businesses can quickly adapt to changing conditions and maintain financial health. Furthermore, the ability to manually adjust collected data and calculated indicators provides the flexibility needed to tailor analysis to specific business needs. This adaptability is especially valuable in dynamic environments, where timely and relevant insights are critical for staying competitive.